Per Internal Revenue Service, the profit or loss statement should be definitely filed if your activity qualifies as business: However, C-EZ version is no longer available, so you should use IRS Form 1040 Schedule C 2022 in both cases. Before 2019 if your income was less than $5,000 in business expenses, you had to fill in the 1040 Schedule C-EZ form instead of C. Knowing your incomes and losses, government defines taxes you need to pay. What I need 2022 - 2023 Schedule C Form 1040 for?įill tax Schedule C form 10 if you are a business owner, statutory employee, sole proprietor, and any other agent with diverse types of incomes. It’s also known as Profit or Loss From Business for Sole Proprietorship. Businesses and professionals who work as sole proprietors use it to report income or loss for a year. Schedule C is an addition to Form 1040 for business owners, self-employers, and people who earn money from a hobby. It shows your income and how much taxes you owe. What is a Schedule C (Form 1040) 2022 - 2023?įorm 1040 is a must-have for all US citizens.

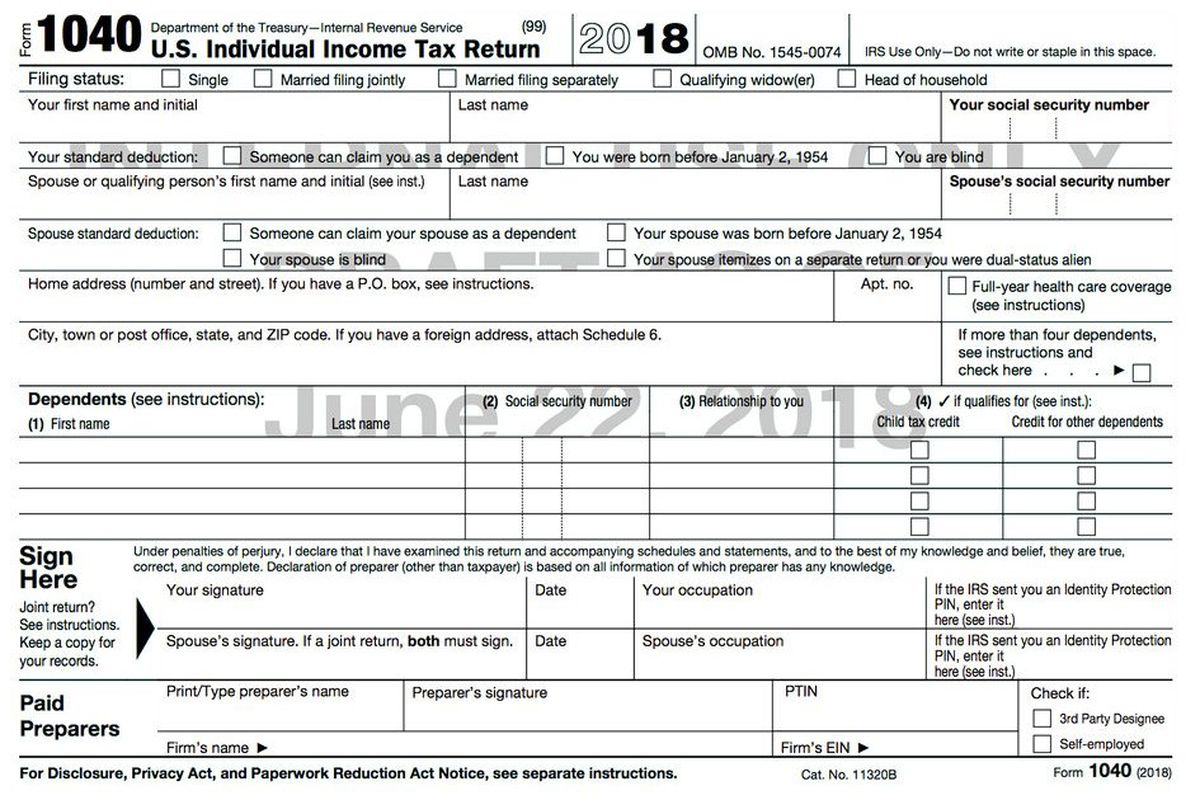

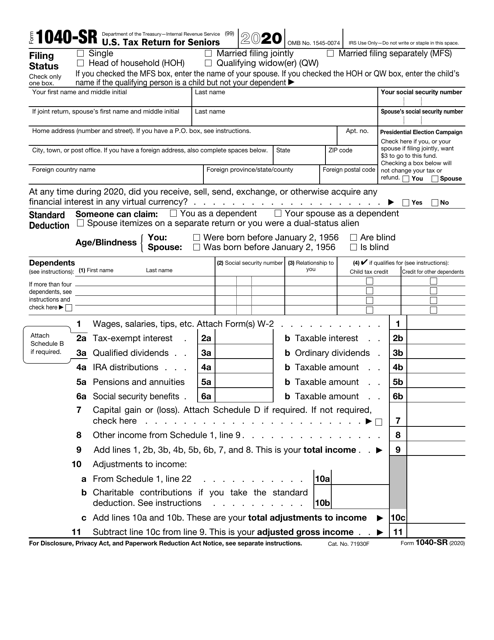

Also, please note, if you have a joint return with your spouse, then get his or her name too Here is necessary to specify your family status, full name, home address, and so on. In general, it divides into two main sections:

This number depends on the level of income

IRS 1040 form is a necessary document for all US citizens to declare their yearly income.

0 kommentar(er)

0 kommentar(er)